Blog

How to Import Technology Equipment and Devices into Colombia?

Importing technology equipment and devices into Colombia is a complex process that involves a number of logistical, customs and regulatory challenges. With the rapid advancement of technology and the growing demand for electronic devices, companies must be well prepared to deal with the particularities of the Colombian market. This blog will guide you through the common challenges, key strategies, and critical aspects to consider when importing technology to Colombia.

Technology Import Process

1. Market Research

The first step in importing technology equipment and devices to Colombia is to conduct a thorough market study. This analysis should include product demand in the Colombian market, existing competition, and consumer preferences. It is also essential to identify emerging technology trends and evaluate how your product can meet those needs. A well-conducted market study will not only allow you to foresee the business opportunities, but also the challenges you may face.

2. Search for Suppliers

Once you have a clear understanding of the market, the next step is to search for reliable suppliers. It is essential to select suppliers that offer quality products, competitive prices and favorable shipping conditions. It is recommended to check the supplier's reputation, review their quality certifications and, if possible, visit their facilities. Establishing a good relationship with the supplier is key to ensure a continuous and reliable flow of products.

3. Tariff Classification

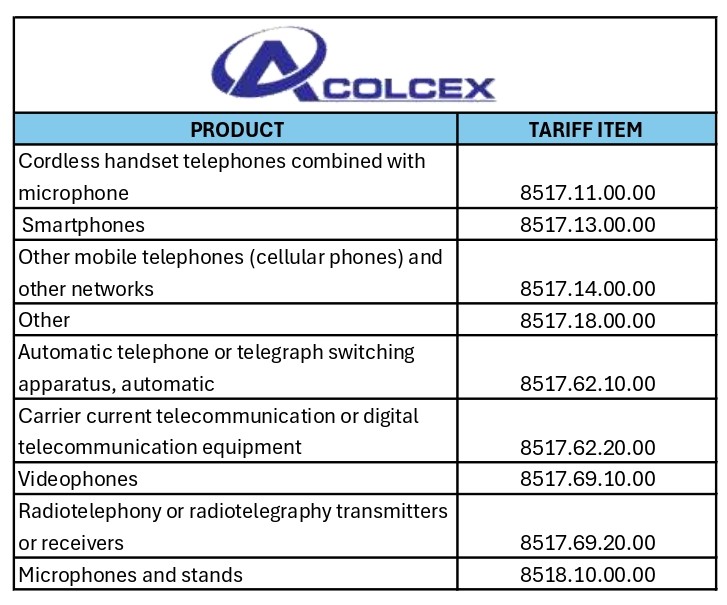

Before proceeding with the import, it is necessary to determine the tariff classification of the equipment and technological devices. In Colombia, tariffs are determined according to the Harmonized Commodity Description and Coding System nomenclature. The specific tariff subheading for your product will define the tariffs you will have to pay, as well as the regulations that apply. It is crucial to perform this step correctly to avoid penalties or delays in the customs process.

Below you will find a table with some tariff headings for technology products.

4. Customs Clearance

Customs clearance is one of the most critical steps in the import process. At this stage, the Import Declaration must be submitted to the National Tax and Customs Directorate (DIAN) through the Foreign Trade Single Window (VUCE). This document must include all relevant information about the merchandise, including tariff classification, value of the merchandise, and country of origin. An error in this process may result in delays or fines.

What are the legal permits for the manufacture, import and distribution of electronic equipment in Colombia?

In Colombia, several permits must be obtained and certain regulations must be complied with:

- Certification of Conformity: All electronic equipment must comply with Colombian technical regulations and obtain a certificate of conformity issued by an authorized body. This certificate guarantees that the products comply with the required safety and quality standards.

- Sanitary Registration (if applicable): Some electronic equipment, especially those that may have medical applications or are health related, may require a sanitary registration issued by the National Institute of Food and Drug Surveillance (INVIMA).

- Environmental License (if applicable): Depending on the environmental impact of the manufacture or distribution of the equipment, it may be necessary to obtain an environmental license from the Ministry of Environment and Sustainable Development.

- Homologation: For telecommunication devices such as cell phones or routers, it is necessary to obtain a homologation from the Communications Regulation Commission (CRC) that verifies that the equipment meets the technical requirements to operate in Colombian networks.

5. Payment of Duties and Taxes

Once the import declaration has been made, it is necessary to proceed with the payment of the corresponding duties and taxes. These payments include the customs duty, which varies according to the tariff classification of the product, and the Value Added Tax (VAT). In some cases, an additional National Consumption Tax (INC) may apply. It is essential to make these payments in a timely manner to avoid problems in the release of the goods.

6. Inspection and Documentation

The DIAN may perform a physical inspection of the equipment and technological devices before allowing their entry into the country. The inspection is intended to verify that the merchandise matches the description in the import declaration and that it complies with the technical and safety regulations in force. In addition, complete documentation must be available, including certificates of conformity, commercial invoices, packing lists, and any other documents required by law.

7. Transportation and Distribution

With the equipment and technological devices already nationalized, the next step is to organize their transportation and distribution within Colombia. This involves selecting the most appropriate means of transportation and coordinating the delivery of the goods to the various distribution points or directly to retailers. It is important to ensure that the transportation is carried out in a safe and efficient manner, avoiding damages that may affect the integrity of the products.

8. Arrival at Retail

Finally, the technological equipment and devices reach retailers, where they will be available to end consumers. At this stage, it is important to ensure that the products are properly labeled and that they comply with all labeling and advertising regulations in Colombia. In addition, retailers must be prepared to offer technical support and guarantee product warranties under Colombian law.

Conclusion

Importing technology equipment and devices into Colombia is a complex process that requires meticulous planning and compliance with various regulations and procedures. From identifying opportunities in the market to getting the product to retailers, each step must be managed with precision. Having a good customs broker, conducting proper market research, and complying with all legal and technical regulations are key aspects to ensure the success of the import. By following this process, companies can take advantage of the opportunities in the Colombian market and meet the growing demand for technology in the country.